If you are a homeowner in Southern California considering solar, you have likely heard of net metering. This policy lets you earn credits for excess electricity your solar panels send to the grid, which you can use later when your system is not producing enough power.

The concept first appeared in the United States in the early 1980s when utilities in Idaho began offering it in 1980, followed by Arizona in 1981. Minnesota was the first state to pass a formal net metering law in 1983 to help jumpstart the emerging solar industry (sources: mepartnership.org, en.wikipedia.org).

California has since refined the approach through three major versions: NEM 1.0, NEM 2.0, and NEM 3.0. Each version changes how much you can save, so knowing the differences is key to planning your solar investment.

How Does Net Metering Work?

When your solar panels generate more electricity than your home uses, the extra energy flows back into the grid. A bi-directional utility meter tracks both the energy you use and the energy you export.

Each kilowatt-hour (kWh) you send to the grid earns you a credit. Later, when your system is not producing enough power, those credits offset the electricity you draw from the grid. Under NEM 1.0 and NEM 2.0, those credits were usually at the full retail rate. Under NEM 3.0, they are based on the lower “avoided cost” rate, which reflects the real-time wholesale value of electricity.

In essence, net metering lets you “bank” solar energy during sunny hours and “withdraw” it when you need it.

NEM 1.0 – The Original Version

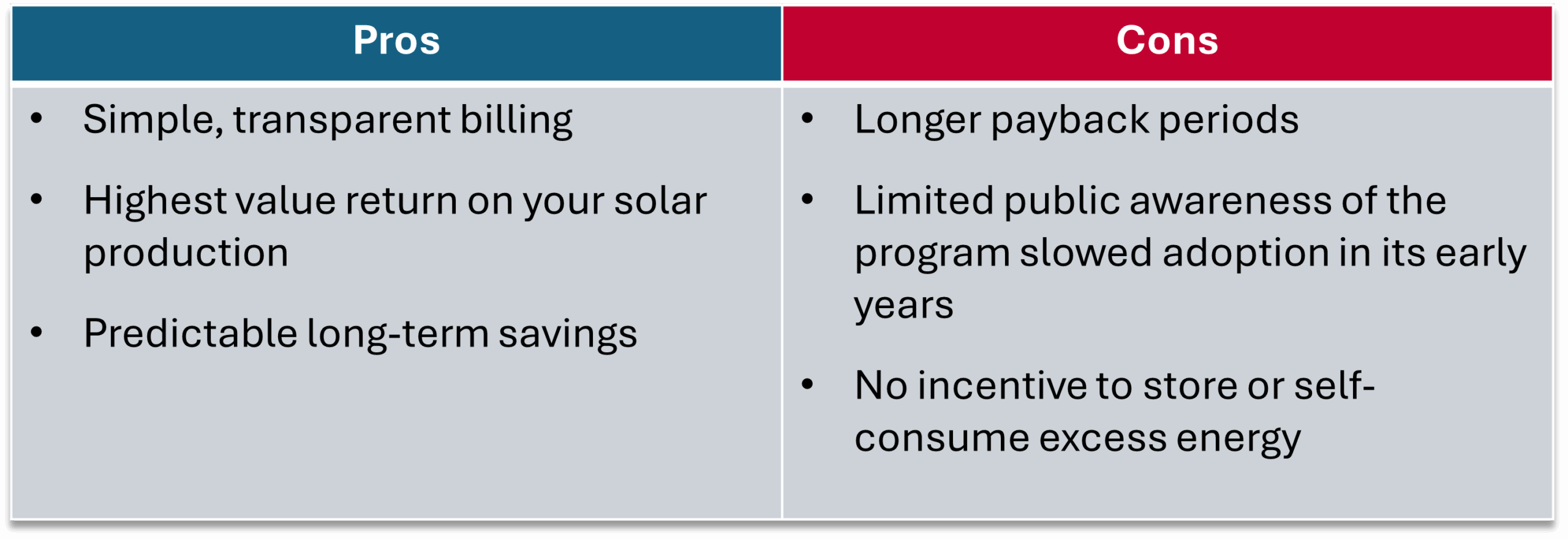

Introduced in the late 1990s, NEM 1.0 was California’s first net metering policy, and it marked a turning point for the solar industry. Before net metering, homeowners with solar could only use the electricity they generated in real time. Any excess power went back to the grid without compensation, essentially giving it away to the utility. This meant that solar systems had to be sized carefully to match daytime usage, and it was difficult for most households to maximize the value of their investment.

NEM 1.0 changed that by allowing homeowners to receive full retail rate credit for every kilowatt-hour (kWh) they exported to the grid. For the first time, excess solar production during the day could directly offset electricity costs at night or during cloudy periods. This credit banking system made solar far more financially viable, encouraged larger system installations, and gave homeowners the flexibility to use the grid as a form of “virtual battery” without additional equipment costs.

NEM 1.0 transformed solar from a niche investment into a viable option for many homeowners. By allowing full retail credits for excess energy, it gave solar owners the flexibility to offset their nighttime and cloudy-day usage with daytime production. While equipment costs were higher back then, the policy’s simplicity and generous terms made it a major step forward for renewable energy adoption in California.

NEM 2.0 – Still Strong, With Added Fees

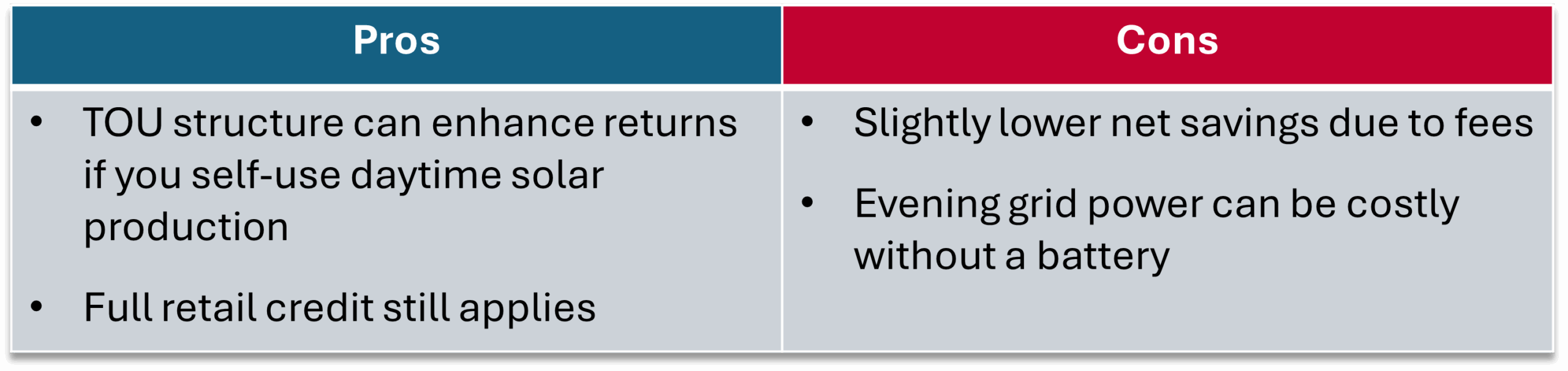

Launched in 2016, NEM 2.0 retained full retail credits but added several requirements and costs. It was designed to keep solar attractive while ensuring all customers contributed to grid maintenance and infrastructure costs, even those producing most of their own energy.

What changed from NEM 1.0:

NEM 2.0 moved customers to time-of-use (TOU) rates, where electricity costs vary by time of day. It also introduced non-bypassable charges, typically 2–3 cents per kWh, that credits cannot offset. Additionally, a one-time interconnection fee, usually a few hundred dollars, was required to tie your system into the grid.

NEM 2.0 maintained the strong benefits of retail credit but introduced fees and time-of-use rates that encouraged homeowners to shift more energy use to daylight hours. While these changes slightly reduced savings for some, smart usage patterns and system design still allowed most solar owners to enjoy significant utility bill reductions.

NEM 3.0 – The Current Program

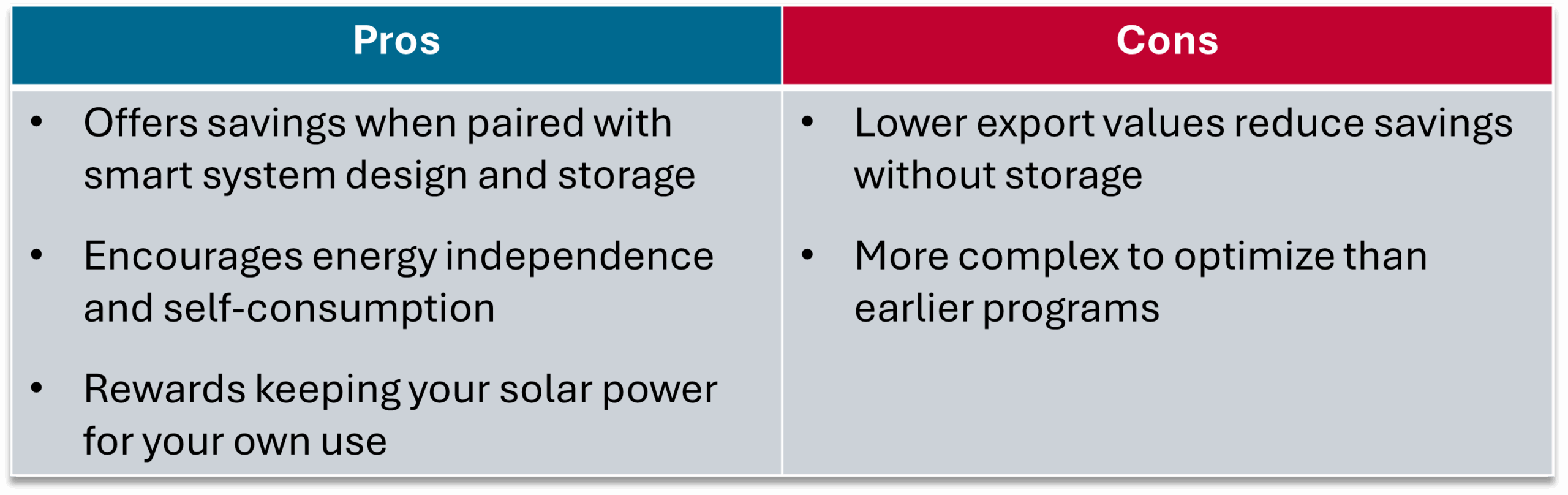

Known as the Net Billing Tariff, NEM 3.0 applies to new solar customers in California today. Exported electricity earns credits at the avoided cost rate, significantly lower than retail and highly variable by hour and season.

What changed from NEM 2.0:

Under NEM 3.0, export credits are reduced by roughly 70 to 80 percent compared to NEM 2.0. The program pushes solar adopters toward battery storage since saving your solar energy for evening use now generates much more value than exporting it. The time-based, dynamic pricing system is far more complex than prior versions.

NEM 3.0’s lower export rates mean that storing your solar energy is now far more valuable than sending it to the grid. This version rewards homeowners who pair their solar system with battery storage or adjust their energy habits to use more power during the day. While it requires more planning than earlier programs, it still offers a path to energy independence and long-term cost savings.

What Triggers a Switch from NEM 2.0 to NEM 3.0?

If you are already on NEM 2.0, your terms remain locked in for 20 years unless you:

- Increase your system size by over 10 percent or more than 1 kW

- Add a battery that significantly changes your export capacity

- Replace your system entirely rather than repairing it

Planning is key to avoiding the accidental loss of your grandfathered benefits.

Final Thoughts

Net metering has transformed solar’s affordability in Southern California. NEM 1.0 and NEM 2.0 provided simple, high-value returns. Today’s NEM 3.0 still rewards smart design, especially when paired with battery storage, but requires strategic planning.

If you are ready to take control of your energy costs and protect yourself from rising utility rates, now is the perfect time to explore your solar options. At OC Solar, we will show you exactly how much you can save with today’s net metering rules and design a system tailored to your needs, whether that is solar alone or solar-plus-storage.

Call us today or request your free, no-obligation solar proposal to see how much your roof could be earning every month.